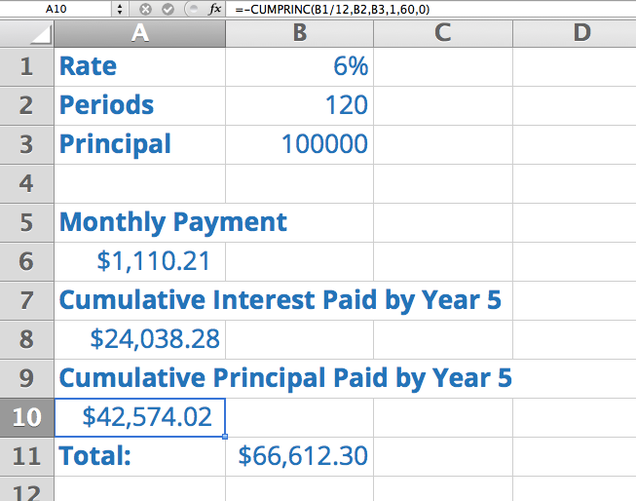

The cumulative principal formula (CUMPRINC) lets you see how much of your loan principal you’ve paid at any given point in time. This formula’s variables mirror those of CUMIPMT, so by filling in those same variables, you’ll see that you’ll pay $100,000 in loan principal over the life of your loan.

“But of course I will!” you say. “That’s just telling my loan principal.” That’s true, so what if you wanted to see how much loan principal you would have paid off halfway through your loan term, aka by year 5 in this case? Set the “end_period” value to “60” and you’ll see that at the halfway point, you’ve paid off about $42,500 in principal.

And if you similarly tweak the CUMIMPT formula, you’ll see that you’ve paid about $24,000 in interest at the halfway point, for a total of $66,612.30 in five years.

That means these formulas can help your forecast your payment outlook over any period of time. If, for instance, you’re considering reamortization, you can use these formulas to better understand how a prepayment a few months in could change your costs.

For those considering refinancing to a Hybrid Loan, you can use these formulas to better assess your comfort with transitioning to a variable rate in order to secure a better upfront interest rate.